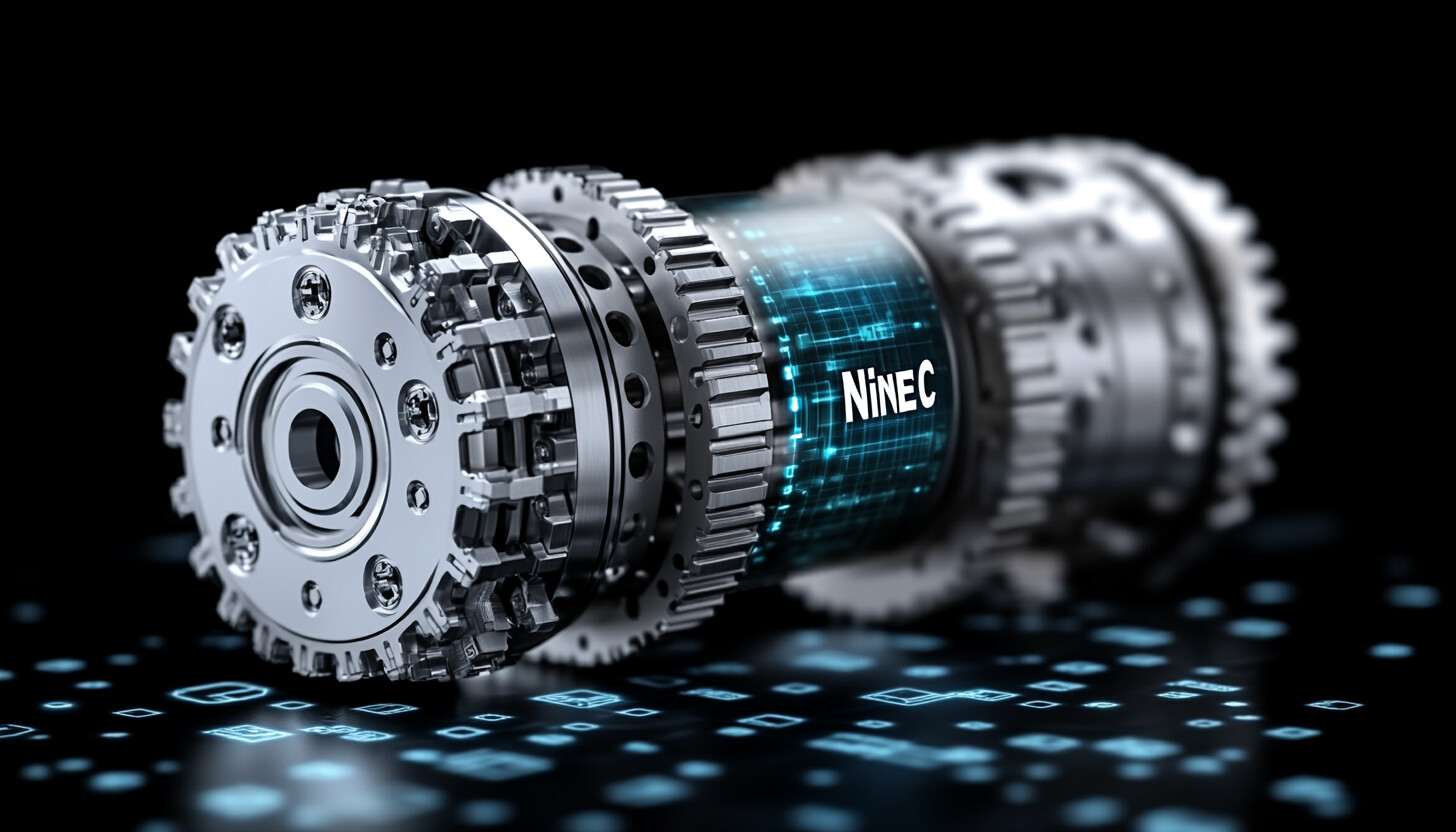

Nidec's $1.6 Billion Bid to Take Makino Milling Private

Explore Nidec's $1.6 billion unsolicited bid to acquire Makino Milling, offering a 42% premium, amid Japan's evolving M&A landscape.

Nidec's Bold Move: $1.6 Billion Unsolicited Bid for Makino Milling

Japanese precision motor giant Nidec has announced an ambitious $1.6 billion unsolicited bid to take Makino Milling private. This strategic move aims to acquire Makino at a 42% premium, showcasing Nidec's aggressive acquisition strategy in the manufacturing sector.

Overview of the Event

- What happened? Nidec declared its intention to acquire Makino Milling Machine through an unsolicited tender offer, valued at approximately 257 billion yen ($1.6 billion).

- When and where did it occur? The announcement was made on December 26, 2024, in Tokyo.

- Why is it significant? This move underscores a growing trend in Japan towards unsolicited takeovers, facilitated by new M&A guidelines promoting industry consolidation.

Context and Background

- Nidec, based in Kyoto, is renowned for its leading role in precision motor manufacturing and a history of aggressive acquisitions, including last year's unsolicited takeover of Takisawa Machine Tool.

- The Japanese government has been encouraging mergers and acquisitions, including unsolicited bids, to foster industry consolidation.

- This bid aligns with broader trends of increased M&A activity in Japan as companies seek growth through strategic acquisitions.

Specifics of the Bid

- Main Players: Nidec Corporation and Makino Milling Machine.

- Core Figures:

- The bid offers a 42% premium over Makino's previous closing share price.

- Offer price: ¥11,000 per share.

- Total bid value: ¥257 billion ($1.6 billion).

- Impact: Shares of Makino went untraded due to a surge of buy orders; Nidec's shares rose by more than 1% following the announcement.

Consequences and Implications

- Immediate Impact: The bid has caused a significant stir in the market, reflecting confidence in Nidec's strategic direction but also raising questions about Makino's future.

- Broader Implications:

- Could set a precedent for similar unsolicited bids in Japan.

- May influence other companies' strategies in the manufacturing sector.

- Highlights potential regulatory scrutiny as Nidec plans to proceed without Makino's initial consent.

Expert Opinions and Analysis

- Analysts view this move as part of Nidec's ongoing strategy to expand its market share and enhance its product offerings through strategic acquisitions.

- Industry experts suggest that if successful, this acquisition could strengthen Nidec's position globally, particularly in the milling machine market.

Responses and Reactions

- Nidec's Stance: Committed to proceeding with the tender offer by April 4, 2025, even without Makino's board approval.

- Market Sentiment: Positive reaction seen in Nidec's share price increase, but uncertainty looms around Makino's response and potential regulatory hurdles.

Conclusion

This unsolicited bid by Nidec not only emphasizes its aggressive expansion strategy but also highlights a shifting landscape in Japan's corporate environment. As the deal progresses, stakeholders are keenly observing the potential ramifications for both companies and the broader industry. Will this bold move by Nidec inspire further unsolicited bids within the Japanese market?