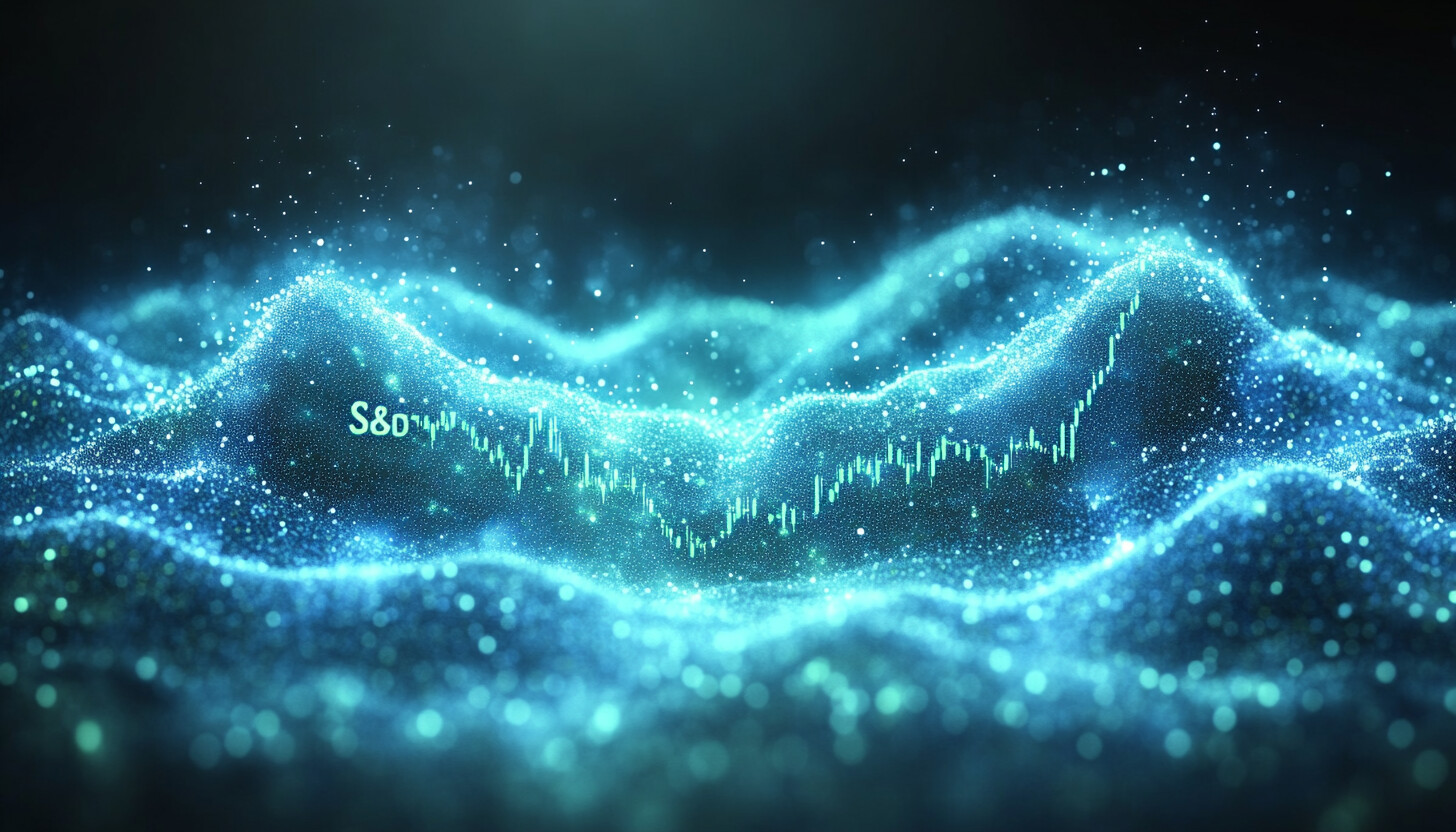

S&P 500: Key Technical Analysis for 2025 Outlook

Explore crucial S&P 500 support and resistance levels for 2025: 5,875, 5,670, 5,445 support and 6,090, 6,290 resistance. Stay updated on market trends and strategies.

S&P 500 Hits Record Highs Amidst Strong Gains

The S&P 500 has achieved its best two-year performance since the late 1990s, driven by a combination of technological advancements and favorable economic conditions. As investors assess the market's potential trajectory for 2025, key technical levels on the index are under close scrutiny.

Overview of Recent Market Activity

In 2024, the S&P 500 surged by more than 20% for the second consecutive year, closing the year with a 23% increase after a strong 24% rise in 2023. These gains were bolstered by the ongoing artificial intelligence boom and interest rate cuts, marking a significant period of growth for large-cap stocks.

Context and Trends

- The index's recent performance is reminiscent of similar market rallies in the late 1990s.

- The AI sector has played a pivotal role in driving stock prices upward.

- Interest rate cuts, the first since 2020, have further supported market expansion.

Key Players and Market Dynamics

- Investors are closely monitoring the policies of the incoming Trump administration, particularly concerning tariffs.

- Geopolitical tensions in regions like Russia and the Middle East remain potential risk factors for market stability.

- The S&P 500 recently formed a head and shoulders pattern, indicating a potential market top.

Technical Analysis: Support and Resistance Levels

- Support Levels:

- 5,875: A critical support level near the head and shoulders neckline.

- 5,670: A potential buying opportunity near historical swing highs and lows.

- 5,445: A trendline support connecting multiple chart points from June to September.

- Resistance Levels:

- 6,090: An overhead resistance near the upper range of recent consolidation.

- 6,290: A projected target using a bars-pattern tool above the all-time high.

Consequences and Market Implications

- Immediate effects include a four-session losing streak at year-end despite overall annual gains.

- Investors are weighing the impact of AI advancements and economic policies on future market trends.

- Long-term outcomes could see sustained growth if technological innovations continue to drive economic expansion.

Expert Insights

Financial analysts highlight the importance of monitoring geopolitical developments and fiscal policies that may influence market movements. The consensus suggests that while the AI boom provides strong support for growth, external factors could introduce volatility.

Market Reactions and Future Outlook

- Investor sentiment remains cautiously optimistic, with attention focused on upcoming fiscal policies and geopolitical developments.

- The S&P 500's resilience amidst potential challenges underscores its role as a benchmark for assessing market health.

In summary, as the S&P 500 enters 2025 with robust performance records, investors are keenly observing key technical levels and external factors that could shape future trends. The interplay of technological innovation and policy decisions will likely continue to influence market dynamics.